There are an awful lot of things that go into selling a house, and there are a whole lot of things that you actually need in order to even begin selling, including a number of documents and paperwork, not to mention if you happen to sell house fast.

If you’ve never had to sell a house before, it can be incredibly difficult and confusing when trying to figure out what exactly you need document-wise when selling.

However, as much of a pain as this can all be, it’s certainly worth looki

ng into in great depth so that you can be completely prepared for what’s to come and what you are going to need along the way.

So, if you’re thinking of selling your house, or are in the process of doing so, here’s all you need to know about what documents you need to sell your house in the UK.

Documents Required For Selling A House

Proof of Identity

This one is pretty straightforward.

You will need to prove your identity to your solicitor and estate agent, which will be requested by them from the very beginning.

In order to do this, you will need to provide a copy of a recent bank statement or utility bill as well as photo ID to accompany it.

A driving license or passport will be accepted as photo ID, so make sure you are prepared for that.

Keep all recent bank statements and invoices for bills handy if you’re thinking of selling your house soon as they will really come in useful.

Shared Freehold Documents

If your home still has a share of the freehold (as in, you’re still paying your mortgage, for example, and thus the bank still owns a part of your house and it’s not completely yours), you will need to provide documentation for this.

If it is a company involved in this, then they should have given you a Share Certificate. This is the adequate documentation, so do find it, or get in touch with said company to rearrange getting another.

Be aware, though, that if your house is leasehold, you will instead need to provide the equivalent documentation in the form of the lease.

Do allow several days or a few weeks for leasehold information to be given to you as it generally depends on the speed of the landlord and/or estate agent and their efficiency.

Energy Performance Certificate (EPC)

It is required by UK law that whenever a house is sold, an EPC is included in the sale.

An Energy Performance Certificate can be obtained with the help of the estate agents, but it’s basically the assessment results on how much energy a house uses and the CO2 output of the house.

Ensure that you have one of these sorted out by the time your house sells in order to avoid any bumps in the final road of the sale.

Also, make sure that whoever you get to give you your EPC is qualified and registered (again, this can be done alongside the help of the estate agent, so do ask them for a hand).

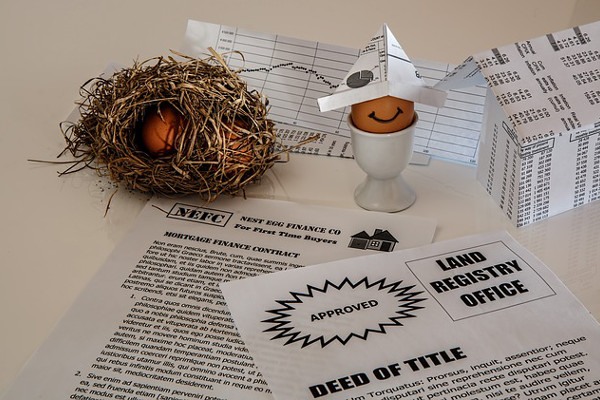

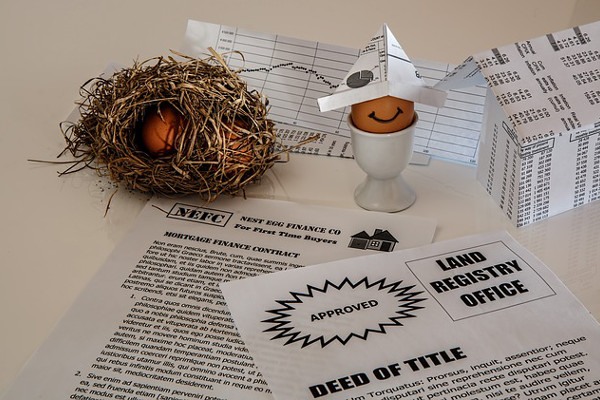

Property Title Deeds

Not everyone has the property title deeds to their house at hand by the time they decide they want to sell up, but there’s no need to worry if you’re one of those people.

You can get the property title deeds sent to you again from the solicitor you used when you initially applied for a mortgage or bought the house.

However, sometimes you can’t get hold of the document, and so you will have to apply for a ‘title absolute’ from the Land Registry.

If your house has not been sold since 1986, the Land Registry is unlikely to have a copy of the property title deeds, so you’ll have to apply for the title absolute.

During the application process for this, you have to prove that you are the legal owner of the house and that you have the right to the freehold of it too.

As well as this, you will have to prove that you’ve had possession of the property for a period of 15 years straight.

This can be a difficult task, so if you have any more questions or difficulties about it, it’s best to contact the Land Registry for help as they will be able to give you the guidance you need.

There’s a lot of paperwork that goes into securing a title absolute, so you’ll probably have to put aside a lot more time and put in a lot more effort than if you were trying to just get hold of the initial property title deeds necessary for selling your house in the UK.

Fittings and Contents Form (TA10)

This document is one that specifies what is incorporated in the sale of your house, so it’s pretty important that you get it right and read it more than once before you sign your life away with it.

It can include furniture if applicable, and also outdoor assets such as garden sheds, garages, greenhouses and even trees.

Remember it may also include washing machines and tumble dryers and the like, so make sure to discuss it properly with the solicitor and estate agent.

TA10 forms also break down the house into rooms and make it clear what is included in the house sale from the kitchen to the bedrooms.

It is also a good idea to ensure that any potential buyers are aware of what’s included in the fittings and contents form so that they can agree on it and there won’t be any huge issues down the line when you’re finalising the sale.

That would be a true pain if it were the case.

Property Information Form (TA6)

All house sellers are required to fill in this form which provides a thoroughly detailed account of the property, similar to the TA10.

The property information form concerns itself with a number of things, including any complaints or disagreements with the neighbours, the boundaries of the garden/house and which neighbour is responsible for the upkeep of certain hedges and fences.

There is also a part on the planning and alterations on the building – if there has been any recent substantial building work done to the house, such as a loft extension or new windows being installed, it is important that this is disclosed on the TA6 form.

Also included on the form should be parking arrangements as potential buyers will want to know whether or not they can park in a designated area owned by them, or if there is no such spot.

Other things included on the form are warrantees and guarantees on certain things that have been installed, such as new windows or solar panels, as well as any proposals and notices from the local authorities about proposed planning or building in the local/surrounding area.

It’s important that any new buyers are warned in advance about this as it could be a potential problem further down the line if they feel misled by the seller when building work begins that they had no idea about.

It is also important that environmental matters are included on this document, such as any risks of flooding or the presence of unwanted substances like Japanese knotweed.

Moreover, there has to be an insurance declaration which gives the potential buyers an idea on how much it will cost to insure your home, taking into account any irregularities with the house that need some form of special insurance.

Moreover, the TA6 also includes services which means the condition of the electrical wiring and central heating – two things that are vitally important to anyone thinking of buying a house.

Ensure you’ve had all of this checked over so you can fill in this document with accuracy so that your back is always covered in any event after the sale of the house.

If you are intending on buying another house, you should declare this on the transaction information part of the form. This is where you can and should also specify any moving dates you have in mind so that the potential buyers are on the same lines as you when it comes to the end of the sale.

Acceptance of Offer Form

Once someone has made an acceptable offer on your house, you will be required to fill in yet more documentation. This will be drafted for you, and then later you will have to sign a Transfer of Deeds form which will be overseen by your solicitor.

This document will include the sale price, the date of the sale’s completion and any legal restrictions that may be imposed upon this.

Once the document has been signed, it officially becomes legally binding and thus if either party withdraws from the agreement, they will owe the other some financial compensation.

Make sure that you’re happy with everything before you sign the document and there shouldn’t be any problems.